UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under §240.14a-12

Liberty Tax,Franchise Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

| (1) Title of each class of securities to which transaction applies: |

|

|

| |

| (2) Aggregate number of securities to which transaction applies: |

|

|

| |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

| |

| (4) Proposed maximum aggregate value of transaction: |

|

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

| (1) Amount Previously paid: |

|

|

| |

| (2) Form, Schedule or Registration Statement No.: |

|

LIBERTY TAX,

FRANCHISE GROUP, INC.

1716 Corporate Landing Parkway2387 Liberty Way

Virginia Beach, Virginia 2345423456

August 12, 2019April 5, 2021

Dear Fellow Stockholder:

You are cordially invited to attend Liberty Tax,Franchise Group, Inc.'s 20192021 Annual Meeting of Stockholders, which will be held via live webcast on Thursday, September 12, 2019Tuesday, May 4, 2021, at 11:3010:00 a.m., Eastern Time, atTime. In light of the continued public health concerns regarding the coronavirus (COVID-19) pandemic and to support the health and well-being of our corporate headquarters located at 1732 Corporate Landing Parkway, Virginia Beach, Virginia 23454. employees, directors and stockholders, we have made the decision to hold the Annual Meeting virtually this year. You will not be able to attend the Annual Meeting physically. Details regarding admissionaccess to the meeting and the business to be conducted are described in this Proxy Statement. We have also made available with this Proxy Statement a copy of our Annual Report to Stockholders,on Form 10-K for the fiscal year ended December 26, 2020, which includes our 20192020 audited consolidated financial statements and provides information about our business.

The attached Proxy Statement, with the accompanying notice of the meeting, describes the matters expected to be acted upon at the meeting. We urge you to review these materials carefully and to take part in the affairs of our Company by voting on the matters described in the accompanying Proxy Statement. We hope that you will be able to attend the meeting.meeting via the webcast. Our directors and management team will be available to answer questions. Afterwards, therequestions, and you will be ahave an opportunity to vote onduring the matters set forth in the accompanying Proxy Statement.meeting.

The Company’s Board of Directors welcomes and appreciates the interest of all our stockholders in Liberty Tax,Franchise Group, Inc.’s affairs and encourages those entitled to vote at the Annual Meeting to take the time to do so. We hope you will attend the Annual Meeting via the webcast, but whether or notif you expectare unable to be personally present,do so, please vote your shares by either: (1) signing, dating and promptly returning the enclosed proxy card in the accompanying postage-paid envelope. envelope, (2) online at www.proxypush.com/frg until 9:59 a.m. (ET) on May 4, 2021, or (3) you may call 1-866-883-3382 via a touch-tone telephone to vote your proxy until 9:59 a.m. (ET) on May 4, 2021. We look forward to your attendance at the virtual meeting and the opportunity to review our developments over the past monthsyear and to share with you our plans for the future.

On behalf of the entire Board of Directors, I'd like to thank you for your commitment and support.

| | | | | | | | |

| | |

| | Sincerely, |

| | |

| | Andrew M. LaurenceMatthew Avril

Chairman of the Board of Directors Liberty Tax,Franchise Group, Inc.

|

| | |

| | |

LIBERTY TAX,

FRANCHISE GROUP, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD SEPTEMBER 12, 2019MAY 4, 2021

The Annual Meeting of Stockholders of Liberty Tax,Franchise Group, Inc. (the "Company") will be held via live webcast on Tuesday, May 4, 2021, at the Company's corporate headquarters located at 1732 Corporate Landing Parkway, Virginia Beach, Virginia 23454, on Thursday, September 12, 2019 at 11:3010:00 a.m., Eastern Time (the "2019"2021 Annual Meeting").

The 20192021 Annual Meeting will be held for the following purposes:

| |

1. | Election of nine (9) directors to the Board of Directors, each to serve until the 2020 annual meeting and until their successors are elected and qualified; |

1.Election of seven (7) directors to the Board of Directors, each to serve until the 2022 annual meeting and until their successors are elected and qualified;

2.Approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the

Proxy Statement;

3.Ratification of the appointment of Deloitte & Touche LLP ("Deloitte") as the Company's independent registered public accounting firm for the fiscal year ending December 25, 2021 ("Fiscal 2021"); and

3. 4.Transaction of any other business that properly comes before the meeting2021 Annual Meeting and any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice. The Board of Directors has fixed the close of business on July 26, 2019March 22, 2021 as the record date for determining stockholders of the Company entitled to receive notice of and vote at the meeting.2021 Annual Meeting.

Stockholders of record of the Company's common stock, par value $0.01 per share ("Common Stock"), as of the close of business on July 26, 2019March 22, 2021 are entitled to receive notice of, and to vote at, the 2019 Annual Meeting. In addition, holders of the Company’s Voting Non-Economic Preferred Stock, par value $0.01 per share (“Preferred Stock”), are also entitled to receive notice of, and to vote at, the 20192021 Annual Meeting. Included in these materials are the Proxy Statement and the Company's 2019 Annual Report to Stockholders ("2019on Form 10-K (the “2020 Annual Report"Report”), as described in this Proxy Statement, which includes the Company's audited consolidated financial statements for the fiscal year ended April 30, 2019December 26, 2020 ("Fiscal 2019"2020"). The notice and proxy card are filed as part of the Proxy Statement. These materials are being sent to stockholders on or about August 12, 2019April 5, 2021 and are also available online at the Company's website at www.libertytax.comwww.franchisegrp.com and at the Securities and Exchange Commission ("SEC") website at www.sec.gov.

|

| | | | | | | |

| | By Order of the Board of Directors, |

| | |

| | M. Brent TurnerBrian R. Kahn

Interim President and Chief Executive Officer

Liberty Tax,Franchise Group, Inc.

|

Virginia Beach, Virginia

August 12, 2019

April 5, 2021

PROXY STATEMENT

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE 20192021 ANNUAL MEETING AND VOTING

PROXY STATEMENT

This proxy statement ("Proxy Statement") is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board") of Liberty Tax,Franchise Group, Inc., a Delaware corporation (the "Company") in connection withfor the Annual Meeting of Stockholders scheduled for September 12, 2019,which will be held via live webcast on May 4, 2021, at 11:3010:00 a.m., Eastern Time at the Company's corporate headquarters located at 1732 Corporate Landing Parkway, Virginia Beach, Virginia 23454 (the "2019"2021 Annual Meeting"). References to the 20192021 Annual Meeting andin this Proxy Statement includeany adjournment or postponement of the 20192021 Annual Meeting. The proxy materials were first mailed to stockholders on or about August 12, 2019.April 5, 2021.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on September 12, 2019May 4, 2021

The notice of the 20192021 Annual Meeting, this Proxy Statement and the 2019Company's Annual Report on Form 10-K for the fiscal year ended December 26, 2020 ("2020 Annual Report") are available online at the Company's website at www.libertytax.com.www.franchisegrp.com.

RECENT TRANSACTIONS

On July 10, 2019, the Company and certain direct or indirect wholly-owned subsidiaries of the Company entered into and completed certain transactions contemplated by an agreement of merger and business combination agreement (the “business combination agreement”) with affiliates of Vintage Capital Management, LLC (“Vintage”), providing for a series of transactions, including the acquisition by the Company of all of the outstanding equity interests in Buddy’s Newco, LLC (“Buddy’s), which operates substantially all of the Buddy’s Home Furnishings business (the “Merger”). A special committee of independent directors of the Board of Directors (the “Special Committee”) and the board of managers of Buddy’s unanimously approved the Merger and the other transactions contemplated by the business combination agreement. As a result of the Merger, each common unit of Buddy’s outstanding immediately prior to the Merger (other than common units held by Buddy’s, the Company, or their respective subsidiaries) was exchanged for 0.091863 shares of Voting Non-Economic Preferred Stock, par value $0.01 per share (the “Preferred Stock”) and 0.459315 common units of Franchise Group New Holdco, LLC, a wholly-owned direct subsidiary of the Company (“New Holdco”, and such common units, the “New Holdco common units”), each of which are, together with one-fifth of a share of Preferred Stock, redeemable on exchange for shares of common stock, par value $0.01 per share (“Common Stock”), pursuant to the certificate of designation for the Preferred Stock and the limited liability company agreement of New Holdco after an initial six-month lockup period.

In connection with the Merger, the Special Committee and the Board also unanimously approved certain amendments (the “Amendments”) to the Company’s Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”). The Amendments provide for, among other things, changing the Company’s name to “Franchise Group, Inc.”; increasing the number of authorized shares of the Company to 200,000,000, of which authorized shares 180,000,000 shares will be Common Stock and 20,000,000 shares will be preferred stock of the Company, par value $0.01 per share (including the Preferred Stock); a requirement that all holders of Common Stock will receive consideration in the same form and of the same kind and amount, calculated on a per share basis, in certain fundamental transactions; and that certain transactions with persons owning 20% or more of the then outstanding Common Stock will require (i) the approval of 66-2/3% of the voting power of the Company’s capital stock held by unaffiliated stockholders, (ii) the approval of independent directors or (iii) the satisfaction of certain price requirements. In addition, certain other conforming and ministerial changes to the Certificate of Incorporation were approved in connection with the changes described above. Pursuant to the business combination agreement, the Board adopted a resolution setting forth the Amendments and declaring its advisability, and the holders of shares of the Company’s outstanding capital stock representing a majority of the total number of votes of the Company’s capital stock as of July 26, 2019 adopted the Amendments by written consent in lieu of a meeting (the “Written Consent”). Under federal securities laws, the Amendments may not become effective until 20 calendar days after the date of distribution of an information statement to the Company’s stockholders. Therefore, notwithstanding the execution and delivery of the Written Consent, the Certificate of Amendment will not be filed with the Secretary of State of the State of Delaware, and the Amendments will not be effective, until that time has elapsed.

VOTING INSTRUCTIONS AND INFORMATION

Who may vote at the 20192021 Annual Meeting?

Each holder of the 16,197,49540,157,102 shares of the Company's Common Stock issued and outstanding at the close of business on July 26, 2019March 22, 2021 ("Record Date") will be entitled to receive a notice of the 20192021 Annual Meeting, and to attend and vote at the 20192021 Annual Meeting. These persons are considered "holders of record," and will be entitled to cast one vote per share owned for each proposal to be considered at the 20192021 Annual Meeting. Additionally, holders of the 1,616,667 shares of Preferred Stock issued in connection with the Merger will also be entitled to receive a notice of the 2019 Annual Meeting, and to attend and vote at the 2019 Annual Meeting. Each share of Preferred Stock has the equivalent voting power of five shares of Common Stock.

What proposals will be voted on at the 20192021 Annual Meeting?

Stockholders will vote on twothree proposals at the 20192021 Annual Meeting:

| |

1. | Election of nine (9) directors to serve on our Board of Directors (Proposal 1); and |

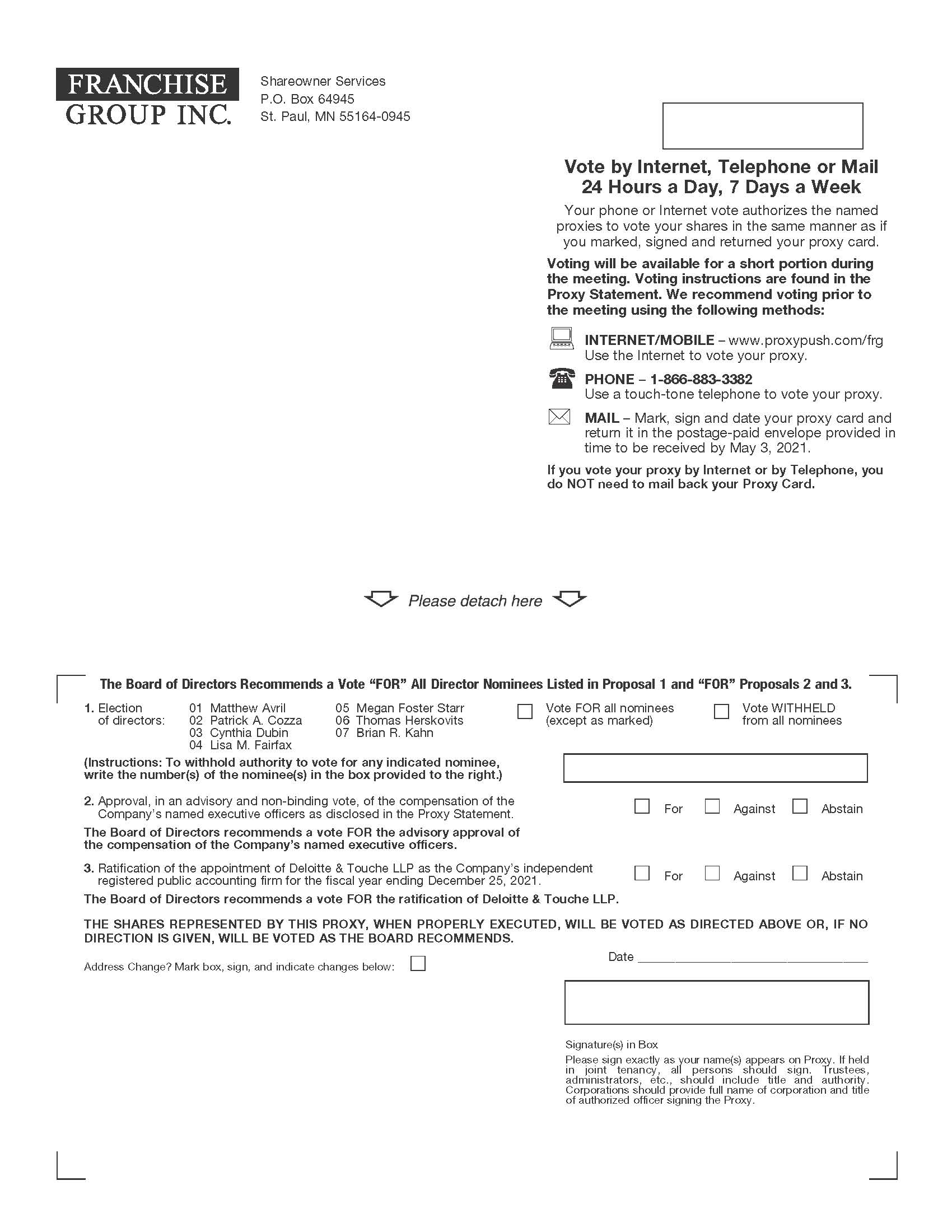

1.Election of seven (7) directors to serve on our Board of Directors (the "Board") (Proposal 1);

| |

2. | Approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement (Proposal 2). |

2.Approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement (Proposal 2);

3.Ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 25, 2021 ("Fiscal 2021") (Proposal 3); and

4.Transaction of any other business that properly comes before the meeting and any adjournment or postponement thereof.

We are not aware of any matters to be presented at the 20192021 Annual Meeting other than those described in this Proxy Statement. If any matters not described in the Proxy Statement are properly presented at the 20192021 Annual Meeting, the proxies will use their own judgment to determine how to vote your shares. If the 20192021 Annual Meeting is adjourned, the proxies may vote your shares at the adjournment or postponement as well.

How does the Board of Directors recommend that I vote on these proposals?

The Board of Directors recommends that you vote your shares:

| |

1. | "FOR" each of the Board's nominees for director (Proposal 1); and |

1. "FOR" each of the Board's nominees for director (Proposal 1);

| |

2. | "FOR" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement (Proposal 2). |

2. "FOR" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement (Proposal 2); and

3. "FOR" the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for Fiscal 2021 (Proposal 3).

Who will bear the cost of this proxy solicitation?

The Company will bear the entire cost of this proxy solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy card, 20192020 Annual Report, and any additional solicitation materials sent by the Company to stockholders. The Company may reimburse brokerage firms and other persons representing beneficial owners of Common Stock and Preferred Stock for their expenses in forwarding the proxy materials to those beneficial owners. In addition, proxies may be solicited by directors, officers and regular employees of the Company, who will not receive any additional compensation for solicitation, by mail, email, facsimile, telephone or personal contact.

What is included in the proxy materials?

The proxy materials include:

•This Proxy Statement for the 20192021 Annual Meeting, including a proxy card; and

•Our 2020 Annual Report.

Our 2019 Annual Report, which includes our audited consolidated financial statements for the fiscal year ended April 30, 2019 ("Fiscal 2019").

If I am a stockholder of record, how do I vote?

You may vote by the following methods:

•By Mail. To vote by mail, by signing, datingyou will need to sign, date and returningreturn the accompanying proxy card that was sent to you with the proxy materials ormaterials.

•By Phone. To vote by phone use a touch-tone telephone and dial 1-866-883-3382. You may only vote your proxy by phone until 9:59 a.m. (ET) on May 4, 2021.

•By Internet. To vote by internet you may alsovisit www.proxypush.com/frg. You may only vote in personyour proxy by written ballot at the 2019 Annual Meeting.Internet until 9:59 a.m. (ET) on May 4, 2021.

How may I obtain directionsattend the 2021 Annual Meeting?

The 2021 Annual Meeting will be via live webcast on May 4, 2021 at 10:00 a.m. EST. To participate in the online meeting:

•You must first register. Visit register.proxypush.com/frg on your smartphone, tablet or computer.

•As a shareholder, you will then be required to enter your control number which is located in the upper right hand corner of your proxy card.

•After registering, you will receive a confirmation email. Approximately one (1) hour prior to the 2019 Annual Meeting?start of the meeting you will receive an email with a unique link to the virtual meeting.

Directions to attend We recommend accessing the 2019 Annual Meeting wherewebcast using an up-to-date internet browser such as Chrome, Firefox, Safari, or Edge.

You may submit questions during the registration process as described above or any time during the virtual Annual Meeting.

If you mayare a stockholder whose shares are held in "street name" (i.e., in the name of a broker, bank or other similar organization), you must contact the broker, bank or other nominee that holds your shares to request an access code and meeting code and, if you would like to vote in person, may be obtained by contactingduring the Corporate Secretary at kathleen.curry@libtax.com.

Voting Before the 2019virtual Annual Meeting, a legal proxy giving you the right to vote your shares. To access the Annual Meeting, visit the link provided above, have your access code and meeting code available, and follow the instructions. You may only vote during the Annual Meeting by emailing a copy of your legal proxy to EQSS-ProxyTabulation@equiniti.com.

How do I vote before the 2021 Annual Meeting?

You may vote either by mail?mail, phone or you may vote online.

If you do not expect to attend the 2019 Annual Meeting in person and choose toVoting by mail.

To vote on the proposals on the agenda by mail, simply complete the proxy card, sign and date it, and return it in the postage-paid envelope provided. If you are a stockholder whose shares are held in "street name" (i.e., in the name of a broker, bank or other similar organization), you may obtain a proxy, executed in your favor, from the record holder. You may sign the proxy card and return it to the Company or to Equiniti Group plc at the address indicated on the proxy card, or you may direct the record holder of your shares to vote your proxy in the manner you specify. Further, if your shares are held in street name, you must communicate your instructions respecting the voting of your shares to the record holder, or your broker will be prohibited from voting your shares. Voting by mail will not affect your right to vote in personduring the meeting if you decide to attend the 20192021 Annual Meeting; however, ifMeeting.

Voting by phone.

To vote on the proposals on the agenda by phone, please dial 1-866-883-3382 and follow the instructions provided by the operator. Please note that you wish to revokemay only vote your proxy by phone until 9:59 a.m. (ET) on May 4, 2021.

Voting by internet.

To vote on the proposals on the agenda by internet, please visit www.proxypush.com/frg. Please note that you may only vote your proxy online until 9:59 a.m. (ET) on May 4, 2021.

How do I vote during the 2021 Annual Meeting?

To vote during the Annual Meeting you must first notifyvote by phone or internet. The meeting website referenced above will direct you to the Corporate Secretary of your intentvoting link to vote online or provide instructions on how to vote on the phone. You will need a control number in person, and must actuallyorder to vote your shares in person atduring the 2019 Annual Meeting. You may vote during the Annual Meeting until the operator indicates that voting has been cut off.

What does it mean if I receive more than one set of proxy materials for the 20192021 Annual Meeting?

It means your shares are held in more than one account. You should vote all of your shares, using the separate proxy card provided with each set of proxy materials.

What is householding?

As permitted by the SEC, only one set of the proxy materials is being delivered to stockholders residing at the same address, unless the stockholders have notified the Company of their desire to receive multiple copies of proxy materials. This is known as householding.

The Company will promptly deliver, upon request, a separate copy of the Proxy Statement or the 20192020 Annual Report to any stockholder residing at an address to which only one copy was mailed. Requests for additional copies for the current year or future years should be directed to the Corporate SecretaryCompany's Assistant General Counsel in writing at 1716 Corporate Landing Parkway,2387 Liberty Way, Virginia Beach, Virginia 23454,23456, Attention: Corporate Secretary,Assistant General Counsel, or by email at kathleen.curry@libtax.com.tiffany.mcwaters@franchisegrp.com.

How may I view the voting results?

The results of voting at the 20192021 Annual Meeting will be filed with the SEC within four business days after the 20192021 Annual Meeting and will be available on the SEC's website (www.sec.gov) or on our website (www.libertytax.com)(www.franchisegrp.com). If the final results are not available at that time, we will provide preliminary voting results in a Current Report on Form 8-K and will provide the final voting results in an amendment to the Current Report on Form 8-K as soon as they are available.

How may I vote in person at the 2019 Annual Meeting?

If you plan to attend the 2019 Annual Meeting and wish to vote your shares in person, you will be asked to present valid government-issued photo identification, such as a driver's license. If you are a holder of record, you will need to bring with you your proxy card to gain admission to the 2019 Annual Meeting. If you require special assistance due to a disability or other reasons, please notify the Corporate Secretary in writing at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454, Attention: Corporate Secretary or by email at kathleen.curry@libtax.com.

If your shares are held by a broker, bank or other similar organization, bring with you to the 2019 Annual Meeting the proxy card, any voting instruction form that is sent to you, or your most recent brokerage statement or a letter from your broker, bank or other similar organization indicating that you beneficially owned the shares of Common Stock or Preferred Stock as of the Record Date. We can use that to verify your beneficial ownership of Common Stock or Preferred Stock and admit you to the 2019 Annual Meeting. If you intend to vote at the 2019 Annual Meeting, you also will need to bring to the 2019 Annual Meeting a legal proxy from your broker, bank or other similar organization that authorizes you to vote the shares that the record holder holds for you in its name.

How may I revoke my proxy?

You may change or revoke your proxy at any time before it is voted at the 20192021 Annual Meeting. You can send a written notice of revocation of your proxy to the Corporate SecretaryAssistant General Counsel so that it is received before the taking of the vote at the 20192021 Annual Meeting. You can also attend the 2019 Annual Meeting and vote in person. Your attendance at the 2019 Annual Meeting will not in and of itself revoke your proxy. In order to revoke your proxy, you must also notify the Corporate SecretaryAssistant General Counsel of your intent to vote in person,another acceptable form, e.g., either by mail, by phone or by voting online, and then vote your shares atbefore the 2019 Annual Meeting.meeting. If you require assistance in changing or revoking your proxy, please contact the Corporate SecretaryAssistant General Counsel at 1716 Corporate Landing Parkway,2387 Liberty Way, Virginia Beach, Virginia 23454,23456, Attention: Corporate SecretaryAssistant General Counsel or by email at kathleen.curry@libtax.com.tiffany.mcwaters@franchisegrp.com.

What constitutes a quorum?

Holders of a majority of the voting power represented by the issued and outstanding shares of capital stock of the Company entitled to vote (taking into account the Preferred Stock) who are present in person or represented by proxy, will constitute a quorum at the 20192021 Annual Meeting. A quorum is required to transact business at the 20192021 Annual Meeting. A representative of Equiniti Group plc has been appointed by the Company's Board of Directors to act as the inspector of elections. The inspector of elections will tabulate the votes cast by proxy or in person at the 20192021 Annual Meeting and will determine whether or not a quorum is present. If a quorum is not present, the 20192021 Annual Meeting may be adjourned in order to solicit additional proxies.

How are votes counted?

Each holder of Common Stock will be entitled to one vote for each share of Common Stock held by such stockholder. Additionally, each share of Preferred Stock has the equivalent voting power of five shares of Common Stock. The holders of Common Stock and Preferred Stock will vote together as a single class on all matters. Except for the election of directors and except as otherwise required by law, the Second Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”) and the Second Amended and Restated Bylaws (the “Bylaws”), the affirmative vote of a majority of the voting power of the shares of capital stock present or represented by proxy at the meeting2021 Annual Meeting and entitled to vote on the subject matter shall be the act of the stockholders. A plurality of the voting power of the shares of capital stock present in person or represented by proxy at the meeting2021 Annual Meeting and entitled to vote with respect to the election of directors shall elect directors.

Election of Directors (Proposal 1)

To be elected as a Director,director, a nominee must receive a plurality of the voting power of the shares of capital stock present in person or represented by proxy and entitled to vote and, therefore, "withhold votes" will not impact the outcome of the elections.

Advisory and Non-Binding Vote to Approve the Compensation of the Company’s Named Executive Officers (Proposal 2)

Approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers requires the affirmative vote of a majority of the voting power of the shares of capital stock present or represented by proxy and entitled to vote at a meeting at which a quorum is present. Under Delaware law, abstentions are counted as shares present and entitled to vote at the meeting.

Therefore, abstentions will have the same effect as a vote "against" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers.

Ratification of Independent Registered Public Accounting Firm (Proposal 3)

Ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for Fiscal 2021 requires the affirmative vote of a majority of the voting power of the shares present or represented by proxy and entitled to vote at a meeting at which a quorum is present. Under Delaware law, abstentions are counted as shares present and entitled to vote at the meeting. Therefore, abstentions will have the same effect as a vote "against" the ratification of the Company's independent registered public accounting firm.

Shares represented by proxy will be voted as directed on the proxy form and, if no direction is given, will be voted as follows:

| |

1. | "FOR" the election of each of the director nominees; |

1."FOR" the election of each of the director nominees;

| |

2. | "FOR" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement; and |

2."FOR" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement;

| |

3. | In the best judgment of the persons named in the proxies, with respect to any other matters that may properly come before the meeting. |

3."FOR" the ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for Fiscal 2021; and

4.In the best judgment of the persons named in the proxies, with respect to any other matters that may properly come before the 2021 Annual Meeting.

What are broker non-votes, and how are they counted?

Brokers, banks or other similar organizations holding shares in street name for customers who are beneficial owners of such shares are prohibited from voting customers' shares on non-routine matters in the absence of specific instructions from those customers. This is commonly referred to as a "broker non-vote." With respect to the proposals in question, broker non-votes will be counted for quorum purposes but will not be counted as "votes cast" either for or against such proposals.

The election of directors and the advisory approval of the compensation of the Company's named executive officers are considered non-routine matters and, therefore, if you hold your shares through a bank, broker or other similar organization, the organization may not vote your shares on these matters absent specific instructions from you. As such, there may be broker non-votes with respect to these matters. Because broker non-votes with respect to these matters will not be counted as "votes cast," if your shares are held in street name, it is critical that you vote or provide specific instructions to your broker, bank or similar organization if you want your vote to count.

If you received more than one proxy card, you may hold shares in more than one account. To ensure that all of your shares are voted, you must signvote each proxy card by one of the approved methods: either by signing and return each proxy card.card by mail, voting each proxy card by phone or voting each proxy card online as described above. You are also always invited tomay attend the 2019 Annual Meeting and vote your shares in person.during the 2021 Annual Meeting.

Is my vote confidential?

Yes, it is our policy that documents identifying your vote are confidential. The vote of any stockholder will not be disclosed to any third party before the final vote count at the 20192021 Annual Meeting except:

•To meet any legal requirements;

•To assert claims for or defend claims against the Company;

•To allow authorized individuals to count and certify the results of the stockholder vote;

•To facilitate a successful proxy solicitation; or

•To respond to stockholders who have written comments on proxy cards.

What is the Company's internet address?

The Company's internet address is www.libertytax.com.www.franchisegrp.com. The Company's filings with the SEC are available free of charge via the "About Liberty""Financial Information" link at this website (click on the "Investor Relations""SEC Filings" heading) and may also be found at the SEC's website at www.sec.gov.

PROPOSAL 1 - ELECTION OF DIRECTORS

BOARD MEMBERSHIP CRITERIA AND PROCESS

In assessing the candidates for recommendation to the Board as director nominees, the Nominating Committee of the Board (the "Nominating Committee") considers the appropriate balance of skills, knowledge, diversity of background and experience, and expertise useful and appropriate to the effective oversight of our business. Additionally, the Nominating Committee takes into account the qualifications of the individual candidate as well as the composition of the Board as a whole. The Nominating Committee is committed to advancing diversity and the Company believes that its director nominees further its commitment to enhancing diversity at the Board level. While the Company does not have a formal policy on Board diversity, we believe a director’s ability to contribute to the diversity of perspectives necessary in Board deliberations is an attribute that is critical to the Company’s long-term success.

The Nominating Committee’s process for identifying and evaluating candidates to be nominees to the Board is typically initiated by identifying a candidate who meets the criteria for selection as a nominee and has the specific qualities or skills being sought based on input from members of the Board, management and, if the Nominating Committee deems appropriate, a third-party search firm which would help to identify candidates. The Nominating Committee considers candidates who are recommended by directors or stockholders, and who satisfy the qualifications we seek in our directors. A stockholder may recommend a director candidate. Instruction for submitting a director nominee is included under the "Nominating Committee" section below.

Our Certificate of Incorporation and Bylaws provide that except as may be provided in a resolution or resolutions of the Board of Directors providing for any series of preferred stock with respect to any directors elected (or to be elected) by the holders of that series, the total number of directors constituting the entire Board of Directors shall consist of not less than five nor more than fifteen members, with the precise number of directors to be determined from time to time by a vote of the Board of Directors.Board.

Except as may be provided in a resolution or resolutions providing for any series of preferred stock with respect to any directors elected (or to be elected) by the holders of that series, any vacancies in the Board of Directors and any newly created directorships resulting

by reason of any increase in the number of directors may be filled only by the affirmative vote of the holders of at least a majority of the shares of the applicable class of capital stock entitled to elect such director, voting together as a single class, and any directors so appointed shall hold office until the next election of directors and until their successors are elected and qualified. As such, any vacancies in the Board of Directors shall be filled by the affirmative vote of the holders of at least a majority of the shares of Common Stock and Preferred Stock, voting together as a single class.

By resolution of the Board, of Directors, the present size of the Board has been established at nine.seven. The Bylaws include an advance notice procedure for stockholder approvals to be brought before an annual meeting of stockholders, including proposed nominations of persons for election to the Board of Directors.Board. No nominations were received for the 20192021 Annual Meeting, and the nineseven nominees for the Board of Directors being recommended for election at the 20192021 Annual Meeting are being recommended by the Board, of Directors, acting upon the recommendation of the Board's Nominating Committee. Each of the nineseven nominees, if elected, will hold office until the next annual meeting of stockholders and until his or her successor is elected and qualified. Four of the seven nominees are current directors of the Board. The Board has nominated Matthew Avril, Patrick A. Cozza, Cynthia S. Dubin, Lisa M. Fairfax, Thomas Herskovits, Brian R. Kahn, Andrew M. Laurence, Lawrence Miller, G. William Minner, Jr., Bryant R. Riley and Kenneth M. YoungMegan Foster Starr for election as directors of the Company. Each nominee has consented to be named and to serve if elected. If any of the nominees becomes unavailable for election for any reason, the proxies will be voted for any substitute nominees.

DIRECTOR NOMINEES

The following table sets forth information regarding our director nominees and designees, as of the date of this Proxy Statement:

|

| | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| Matthew Avril | | 5860 | | Director |

| Patrick A. Cozza | | 6365 | | Director |

| Cynthia S. Dubin | | 59 | | Director |

| Lisa M. Fairfax | | 50 | | Director |

| Thomas Herskovits | | 7274 | | Director |

| Brian R. Kahn | | 4547 | | Director |

Andrew M. LaurenceMegan Foster Starr | | 4433 | | Director |

Lawrence Miller | | 70 | | Director |

G. William Minner, Jr. | | 66 | | Director |

Bryant R. Riley | | 52 | | Director |

Kenneth M. Young | | 55 | | Director |

QUALIFICATIONS AND EXPERIENCE OF DIRECTOR NOMINEES

Matthew Avril. Mr. Avril, age 58,60, has served as a director of the Company since September 2018 and is a self-employed consultant. He was appointed as Chairman of the Board of Directors in March 2020. He is currently a member of the strategic advisory board of Vintage. SinceVintage Capital Management, LLC (“Vintage”). From January 2018 to June 2020, he has beenserved as a director of Babcock & Wilcox.Wilcox Enterprises, Inc. (“Babcock & Wilcox”), a global leader in energy and environmental technologies and services for the power and industrial markets. From November 2016 to March 2017, he served as Chief Executive Officer of Diamond Resorts International, Inc., a company in the hospitality and vacation ownership industries.company. From July 2014 until June 2016, Mr. Avril was a director of Aaron’s, Inc., a leader in the sales and lease ownership and specialty retailing of residential furniture, consumer electronics, home appliances and accessories.From March 2011 to April 2016, Mr. Avril was a director of API Technologies.Technologies Corporation, a developer of radio frequency and microwave, power and securities applications. From February 2015 to March 2016, he was consultant to and Chief Executive Officer-elect for Vistana Signature Experiences, Inc. (“Vistana”), a vacation ownership business. Previously, he served as President, Hotel Group, for Starwood Hotels & Resorts Worldwide, Inc. (“Starwood”), an international hotel and leisure company with extensive franchise operations, from August 2008 to July 2012. From 2002 to 2008, he served

in a number of executive leadership positions with Starwood, and from 1989 to 1998, held various senior leadership positions with Vistana. Mr. Avril’s management background provides substantial additional expertise to the Board. Mr. Avril is a Certified Public Accountant (inactive status). Mr. Avril received a B.S. in Accounting from the University of Miami.

Patrick A. Cozza. Mr. Cozza, age 63,65, has served as a directorDirector of the Company since May 2018 and is managing partner of Cozza Enterprises, LLC, a firm that provides strategic consultation and executive coaching services, a position he has held since January 2014.2018. Mr. Cozza also serves as an Executive in Residence, Lecturer and Lecturer, Wealth Management,Professor at the Silberman College of Business, Fairleigh Dickinson University. Mr. Cozza was formerly Chairman and Chief Executive Officer of HSBC Insurance North America, which operated four insurance companies with operations in the United States, Canada, Mexico, India and the United Kingdom, from January 2006 to December 2014. Concurrently, Mr. Cozza served as Senior Executive Vice President, Retail Banking and Wealth Management -– North America for HSBC from January 2011 to December 2014, and previously served as Group Executive, Taxpayer Financial Services and North America and Mexico Insurance for HSBC from January 2002 to December 2006. HSBC Holdings plc, is one of the world’s largest banking and financial services organizations.organizations, from January 2002 to December 2006. Mr. Cozza was also Chief Executive Officer of Taxpayer Financial Services from 2000 to 2002 and held a variety of senior leadership positions, including Chief Financial Officer, Chief Operating Officer and President of the Beneficial Insurance Group subsidiaries of Beneficial Corporation from 1985 to 1998. Mr. Cozza serves on the Boards of Directors of Scottish Re Life Insurance Company, the National Association of Corporate Directors, New Jersey Chapter,where he holds the designation of Board Leadership Fellow, Private Directors Association, Junior Achievement of New Jersey and the Silberman College of Business at Fairleigh Dickinson University. Mr. Cozza provides substantial management, leadership and strategic business experience and expertise to the Board of Directors. Mr. Cozza received a B.S. from Seton Hall University and an M.B.A. from Fairleigh Dickinson University.

Cynthia S. Dubin. Ms Dubin, age 59, is an experienced chief financial officer and board director. In February 2019, Ms. Dubin was appointed to the board of the U.K. Competition and Markets Authority ("CMA") and is the Interim-Chair of its Audit and Risk Assurance Committee and Chair of the Nominations Committee. The CMA is a non-ministerial government department, responsible for strengthening business competition and preventing and reducing anti-competitive activities. In March of 2019, she was appointed to the board of Hurco Group Companies and sits on their Audit Committee. Hurco, Nasdaq-listed, is an industrial technology company that designs and produces interactive computer controls, software and computerized machine tools. From 2015 to September 2020, she served on the Board of Directors of Babcock & Wilcox Enterprises, Inc., a NYSE-listed global leader in advanced energy and environmental technologies and services. During her service, she served as the Chair of its Audit and Finance Committee and a member of its Governance Committee. Since July 2020, Ms. Dubin has served as a director for Synthomer plc, a London Stock Exchange traded chemicals manufacturer and is the Chair of its Audit Committee and a member of its Remuneration Committee. Since December 2020, Ms. Dubin has also served as a director for ICE Futures Europe, an exchange for futures and options contracts for crude oil, interest rates, equity derivatives, natural gas, power, coal, emissions, and soft commodities, and is a member of its Risk and Audit Committee. Ms. Dubin served as the CFO of Pivot Power LLP, an emerging leader in power storage and electric vehicle infrastructure in the U.K., from August 2018 to March 2019. Ms. Dubin was also the CFO for JKX Oil & Gas plc, from 2011 to 2016 and CFO for Canamens Ltd. from 2006 to 2011. These companies were London Stock Exchange listed and private equity-backed oil and gas exploration and production companies, respectively. Previously, Ms. Dubin was European CFO for a pre-eminent builder, owner and operator of large-scale power generation projects and started her career as a project finance banker. Ms. Dubin received a B.S. (finance and economics) from Georgetown University.

Lisa M. Fairfax. Ms.Fairfax, age 50, is currently a tenured and chaired professor at the George Washington University Law School ("GW") where she is the Alexander Hamilton Professor of Business Law, and the Founder and Director of the GW Corporate Law and Governance Initiative. From September 2015 to August 2019, Ms. Fairfax served as an appointed member of the Investor Advisory Committee of the Securities and Exchange Commission (“SEC”). From January 2008 to December 2011, Ms. Fairfax served as a

member of the National Adjudicatory Council of the Financial Industry Regulation Authority (“FINRA”). From June 2008 to June 2012, Ms. Fairfax served on FINRA’s NASDAQ Market Regulation Committee. Ms. Fairfax is currently Chair of the Board of Georgetown Day School, an independent K-12 school in Washington, D.C.Ms. Fairfax serves on the Board of DirectWomen, a nonprofit focused on increasing public company board diversity, and is a member of DirectWomen’s finance and audit committee.Ms. Fairfax is an elected member of the American Law Institute (“ALI”), and serves on the Advisory Group for the ALI’s Restatement of the Law, Corporate Governance.Ms. Fairfax is a member of the SEC Historical Society Board of Advisors.Prior to joining GW, Ms. Fairfax was a tenured professor and Director of the Business Law Program at the University of Maryland School of Law. Before entering academia, Ms. Fairfax practiced corporate and securities law with Ropes & Gray LLP in Boston and the District of Columbia. Ms. Fairfax’s financial services, securities, capital markets, regulatory environment, board oversight and duties, and corporate governance background provides substantial additional expertise to the Board. Ms. Fairfax received a Juris Doctorate from Harvard Law School with honors and an A.B. from Harvard College with honors.

Thomas Herskovits. Mr. Herskovits, age 72,74, served as a director of the Company from October 2015 until November 2017 and was reappointed to serve as a director in March 2018. Since 2014, Mr. Herskovits has been managing director of Feldman Advisors, a middle market investment banking firm based in Chicago, and since 1996, he has managed private investments through Herskovits Enterprises. From 2013 through February 2014, he was CEO of WinView, Inc., a privately-held technology company. Hecompany, and served on the Board of Directors of that privately-held company from 2012 to 2015. He previously served as non-operating Chairman of the Board of Directors of Natural Golf Corporation, a golf equipment and instruction company, as President & CEO of Specialty Foods, and as President of Kraft Dairy and Frozen Products. Mr. Herskovits was President of the Breakfast Foods Division of General Foods and spent the first nine years of his career in brand management at The Procter & Gamble Company. Mr. Herskovits’ management, finance and consumer products backgrounds provide substantial additional expertise to the Board. Mr. Herskovits received a B.S. in Architecture and Finance and an M.B.A. in Finance and Marketing from Syracuse University.

Brian R. Kahn. Mr. Kahn, age 45,47, has served as a director of the Company since September 2018 and as the Company's President and Chief Executive Officer since October 2019. Mr. Kahn founded and has served as the investment manager of Vintage and its predecessor, Kahn Capital Management, LLC, since 1998. Vintage is a value-oriented, operations-focused, private and public equity investor specializing in the consumer, aerospace and defense, and manufacturing sectors. Since 2012, Mr. Kahn has served as Chairman of the Board of Directors of Buddy’s Newco LLC, an operator and franchisor of rent-to-own stores under the banners of Buddy’s Home Furnishings, Flexi Compras Corp., and Good-to-Go Wheels and Tires. Since January 2018, Mr. Kahn has been a director of Babcock & Wilcox Enterprises, Inc. (“Babcock & Wilcox”), a global leader in energy and environmental technologies and services for the power and industrial markets. Previously, Mr. Kahn was the Chairman of the boardBoard of directors

Directors of API Technologies Corporation, a developer of radio frequency and microwave, power and securities applications,from 2011 until 2016 and White Electronic Designs Corporation from 2009 until 2010. Mr. Kahn has also served as a director of Aaron’s, Inc., a leader in the sales and lease ownership and specialty retailing of residential furniture, consumer electronics, home appliances and accessories from 2014 until 2015, and Integral Systems, Inc., a provider of products, systems and services for satellite command and control, telemetry and digital signal processing, data communications, enterprise network management and communications information assurance, from 2011 to 2012.2012, and Babcock & Wilcox, a global leader in energy and environmental technologies and services for the power and industrial markets, from 2018 to 2020. Mr. Kahn brings to the Board extensive management and consumer finance expertise, as well as public company experience. Mr. Kahn received a B.A. from Harvard University.

Andrew M. Laurence. Megan Foster StarrMr. Laurence,. Ms. Starr, age 44, has served as33, is the Global Head of Impact for The Carlyle Group (“Carlye”), a director ofglobal investment firm, where she works to design and execute Carlyle’s cohesive, long-term impact strategy. Ms. Starr also oversees Carlye’s environmental, social and governance (“ESG”) team, which leads the Company since September 2018 and is a partner of Vintage. Mr. Laurence joined Vintage in January 2010 and is responsible for all aspects of its transaction sourcing, duefirm’s investment diligence and execution. Mr. Laurenceportfolio company engagement work on material ESG issues. Prior to joining Carlyle, Ms. Starr was within Goldman Sachs’ Investment Management Division, where she helped build the ESG and impact investing business. Previously, Ms. Starr served as Corporate Secretary of API Technologies from January 2011 until February 2016; he also served as Vice President of Finance and Chief Accounting Officer from January 2011 to June 2011. Since January 2015, Mr. Laurence has beenin roles at The JPB Foundation, a director and member of the audit committee of IEC Electronics Corp., a provider of electronic manufacturing services to advanced technology companies that produce life-saving and mission critical products for the medical, industrial, aerospace and defense sectors. Mr. Laurence also serves as a director of Energes Services, LLC, an oilfield services company located in Colorado and as Manager of East Coast Welding & Fabrication, LLC, a metals fabrication business$3.8 billion private family foundation based in Massachusetts. HeNew York City. Ms. Starr is also a directoron the Board of non-profits Good Sports, Inc. and Beth Israel Deaconess Hospital - Milton. Mr. Laurence’s finance experience provides substantial expertise to the Board. Mr. Laurence received a B.A. from Harvard University.

Lawrence Miller. Mr. Miller, age 70, has servedDirectors for Falmouth Academy, an independent college-preparatory school, as a director of the Company since May 2018 and is the founder and Vice Chairman ofwell as the Board of Directors of StoneMor Partners L.P.,The Carbon Endowment, an owner and operator of cemeteries and funeral homes in the United States. From April 2004 to May 2017, Mr. Miller was Chairman of the Board, President and Chief Executive Officer of StoneMor Partners L.P. He also served as the Chief Executive Officer and President of Cornerstone Family Services from March 1999 through April 2004. Prior to joining Cornerstone, Mr. Miller was employed by The Loewen Group, Inc. (now known as the Alderwoods Group, Inc.), where he served in various management positions, including Executive Vice President of Operations from January 1997 until June 1998, and President of the Cemetery Division from March of 1995 until December 1996. Prior to joining The Loewen Group, Mr. Miller served as President and Chief Executive Officer of Osiris Holding Corporation, a private consolidator of cemeteries and funeral homes of which Mr. Miller was a one-third owner, from November 1987 until March 1995, when Osiris was sold to The Loewen Group. Mr. Miller served as President and Chief Operating Officer of Morlan International, Inc., one of the first publicly traded cemetery and funeral home consolidators from 1982 until 1987, when Morlan was sold to Service Corporation International. Mr. Miller brings to the Board of Directors extensive operating and managerial expertise, excellent leadership skills and significant experience in advancing growth strategies, including acquisitions and strategic alliances. Mr. Miller received a B.B.A and an M.B.A. in Finance from Temple University.

G. William Minner, Jr. Mr. Minner, age 66, has served as a director of the Company since February 2018. Since 1996, Mr. Minner has served as a contract Chief Financial Officer and consultant with responsibilities for finance and administration to over 25 companies. From June 1991 to December 1995, Mr. Minner served as Chairman, President and Chief Executive Officer of Suburban Federal Savings Bank in Collingdale, Pennsylvania. From December 1988 to May 1991, Mr. Minner served in various positions with Atlantic Financial Savings, F.A., including Senior Vice President - Credit and First Vice President - Loan Workout. Previously, Mr. Minner served as Audit Manager and Controller for the mortgage subsidiary of Magnet Bank, FSB from July 1984 to December 1988. Mr. Minner is a Certified Public Accountant. Mr. Minner has substantial experience in the financial services industry, including banking, lending, risk management, treasury management, financial analysis, SEC reporting, taxation, accounting and commercial real estate development. Mr. Minner qualifies as an audit committee financial expert under SEC rules. Mr. Minnerenvironmental non-profit. Ms. Starr received an M.B.A. and M.S.a Certificate in AccountingPublic Management and Social Innovation from Marshall University.

Bryant R. Riley. Mr. Riley, age 52, has served as a directorStanford University’s Graduate School of the Company since September 2018 and has served as Chief Executive Officer and Chairman of B. Riley Financial, Inc. (“B. Riley”), a leader in providing a diverse suite of financial services and solutions for public and private companies as well as high net worth individuals, since June 2014, and as a director since August 2009. Previously, Mr. Riley served as the Co-Chief Executive Officer of B. Riley FBR, Inc. (formerly FBR Capital Markets & Co., LLC) from July 2017 to July 2018, as the Chairman of B. Riley & Co., LLC since founding the stock brokerage firm in 1997 and as Chief Executive Officer

of B. Riley & Co., LLC from 1997 to 2006. He also previously served as Chairman of DDi Corp from May 2007 to May 2012 and Chairman of Lightbridge Communications Corporation (“LCC”) from October 2009 to October 2015. He also previously served on the boards of Cadiz Inc. from April 2013 to June 2014, Strasbaugh from July 2010 to August 2013, and STR Holdings, Inc. from March 2014 to August 2014. Mr. Riley’s public company experience, as well as his management expertise, provides substantial additional expertise to the Board. He also served on the board of directors for several private companies. Mr. Riley received a B.S. from Lehigh University.

Kenneth M. Young. Mr. Young, age 55, has served as a director of the Company since September 2018 and currently serves as President of B. Riley. In addition, Mr. Young serves as Chief Executive Officer for B. Riley Principal Investments, a wholly-owned subsidiary of B. Riley, which acquires, invests and operates harvest opportunities across several verticals, including communications, media, construction, and retail, with a focus on maximizing cash flows through operational expertise. Mr. Young has served on the boards of Orion Energy Systems, Inc., a manufacturer of high quality, industry leading LED lighting products, since August 2017 and Globalstar, Inc., a provider of mobile satellite services, since September 2015, and bebe stores, inc., a global brand clothing retailer, since January 2018. He also served on the boards of Proxim Wireless Corporation from December 2016 until July 2018, Special Diversified Opportunities Inc. from March 2015 until May 2017,Business, where he served on the compensation committee, and B. Riley from December 2014 to September 2016, where heshe was the chair of the audit committee and served on the compensation committees and governance committees. Mr. Young has 30 years of operational, executive and director experience primarily within the communications and finance industry. Previously, he served as Chief Marketing Officer and Chief Operating Officer of the Americas at LCC from 2006 to 2008 before serving as President and Chief Executive Officer from 2008 to 2016. Prior to joining LCC, Mr. Young held various senior executive positions with multiple corporations, including Liberty Media’s TruePosition Location Services subsidiary. Additionally, Mr. Young held senior positions within Cingular Wireless, SBC Wireless, Southwestern Bell Telephone and AT&T as part of his 16-year tenure within the now combined AT&T Corporation. Mr. Young’s background in finance, as well as his management skills, provide valuable experience to the Board of Directors. Mr. Young holds a B.S. from Graceland Universityan Arbuckle Leadership Fellow, and an MBAA.B. in Environmental Science and Public Policy from the UniversityHarvard College, where she graduated magna cum laude with highest honors in field of Southern Illinois.concentration.

COMMITTEES OF THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our Board of Directors currently has four standing committees: the Audit Committee, the Compensation Committee, the Nominating Committee and the Risk Committee. The responsibilities of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors.Board. The chart below reflects the current composition of each of the standing committees.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Director | | Audit Committee | | Compensation Committee | | Nominating Committee | | Risk Committee |

| Matthew Avril | | | | X | | | | X | | | | |

| Patrick A. Cozza | | X | | X(1) | | X | | |

| Thomas Herskovits | | | | | | X(1) | | X |

| Brian R. Kahn | | | | | | X | | |

| Andrew M. Laurence | | | | | | | | X |

| Lawrence Miller | | | | | | X | | | | X(1) |

| G. William Minner, Jr. | | X(1) | | | | X | | | | |

Bryant R. Riley | | X | | | | | | |

Kenneth M. Young | | | | X | | X | | |

(1) Chairperson of Committee

Audit Committee

Our Audit Committee, which met thirteen times during Fiscal 2019,2020, provides oversight of our accounting and financial reporting process, the audit of our financial statements and our internal control function. Among other matters, the Audit Committee assists the Board of Directors in oversight of the independent auditors' qualifications, independence and performance; is responsible for the engagement, retention and compensation of the independent auditors; reviews the scope of the annual audit; reviews and discusses with management and the independent auditors the results of the annual audit and the review of our quarterly consolidated financial statements, including the disclosures in our annual and quarterly reports filed with the Securities and Exchange Commission (the "SEC");SEC; reviews and oversees risk management related to financial matters; establishes procedures for receiving, retaining and investigating complaints received by us regarding accounting, internal accounting controls or audit matters; approves audit and permissible non-audit services provided by our independent auditor; and reviews and approves related party transactions under Item 404 of Regulation S-K. In addition, our Audit Committee oversees our internal audit function.

All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our Board of Directors has determined that Mr. Minner has been designated the Company’s audit committee financial expert as defined under the applicable rules of the SEC and NASDAQ. The current membersAll of the Audit Committee are listed above. The members of the Audit Committee during Fiscal 2019 were Messrs. Laurence, Minner and Herskovits and Mr. Ross Longfield. All of the

current members of our Audit Committee are, and all of the members who served on the Audit Committee during Fiscal 20192020 were, independent as defined under the applicable rules and regulations of the SEC and NASDAQ. The Board has adopted a written Audit Committee Charter, which is available at the Company's website at www.libertytax.comwww.franchisegrp.com or upon written request to the Corporate Secretary,Assistant General Counsel, Franchise Group, Inc., 2387 Liberty Tax, Inc., 1716 Corporate Landing Parkway,Way, Virginia Beach, Virginia 23454.23456.

Compensation Committee

Our Compensation Committee, which met eightfour times during Fiscal 2019,2020, adopts and administers the compensation policies, plans and benefit programs for our executive officers and all other members of our executive team. In addition, among other things, our Compensation Committee annually evaluates, in consultation with the Board of Directors, the performance of our Chief Executive Officer, reviews and approves corporate goals and objectives relevant to compensation of our Chief Executive Officer and other executives and evaluates the performance of these executives in light of those goals and objectives. Our Compensation Committee also adopts and administers our equity compensation plans.

The current members of the Compensation Committee are listed above. The members of the Compensation Committee during Fiscal 2019 were Messrs. Avril, Cozza, Herskovits, Longfield, Minner, and Young. All of the current members of our Compensation Committee are, and all of the members who served on the Compensation Committee during Fiscal 20192020 were, independent under the applicable rules and regulations of the SEC and NASDAQ, and Section 162(m) of the Internal Revenue Code (the “Code”). The Board has adopted a written Compensation Committee Charter, which is available at the Company's website at www.libertytax.comwww.franchisegrp.com or upon written request to the Corporate Secretary,Assistant General Counsel, Franchise Group, Inc., 2387 Liberty Tax, Inc., 1716 Corporate Landing Parkway,Way, Virginia Beach, Virginia 23454.23456.

Nominating Committee

Our Nominating Committee, which met four times during Fiscal 2019,2020, is responsible for, among other things, making recommendations regarding the composition of our Board, of Directors, identification, evaluation and nomination of director candidates and the structure and composition of committees of our Board of Directors.Board. The Nominating Committee is also responsible for considering candidates nominated by stockholders for election to the Board, evaluating the proposed candidates and making recommendations regarding the candidates to the Board. The Nominating Committee considers candidates for Board membership recommended by its members and other Board members, as well as by management and stockholders. While there are no formal procedures for stockholders to submit director candidate recommendations, the Nominating Committee will consider candidates recommended in writing by stockholders entitled to vote in the election of directors. Such written submissions should include the name, address, and telephone number of the recommended candidate, along with a brief statement of the candidate's qualifications to serve as a director. All such stockholder recommendations should be submitted to the attention of the Company’s SecretaryAssistant General Counsel at the Company’s principal office located at Corporate Secretary,Franchise Group, Inc., 2387 Liberty Tax, Inc., 1716 Corporate Landing Parkway,Way, Virginia Beach, Virginia 2345423456 and must be received in a reasonable time prior to the next annual election of directors to be considered by the Nominating Committee. Any director candidate recommended by a stockholder will be reviewed and considered by the Nominating Committee in the same manner as all other director candidates based on the qualifications described in this section. In addition, our Nominating Committee approves our Committee charters, oversees compliance with our code of business conduct and ethics, reviews actual and potential conflicts of interest of our directors and officers other than related party transactions reviewed by the Audit Committee and oversees the Board self-evaluation process.

In evaluating candidates for election to the Board, the Nominating Committee takes into account the qualifications of the individual candidate as well as the composition of the Board as a whole. In nominating candidates, the Committee takes into consideration the qualifications for directors included in the Board Charter and Corporate Governance Guidelines and such other factors as it deems appropriate. These factors may include judgment, skill, diversity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. Pursuant to its Charter, the Nominating Committee has the authority to retain consultants or search firms to identify director candidates.

The current members of the Nominating Committee are listed above. The members of the Nominating Committee during Fiscal 2019 were Messrs. Herskovits, Kahn, Longfield, Miller, Minner and Young. All of the current members of our Nominating Committee are, and all members who served on the Nominating Committee during Fiscal 20192020 were, independent under the rules and regulations of NASDAQ. The Board has adopted a written Nominating Committee Charter, which is available at the Company’s website at www.libertytax.comwww.franchisegrp.com or upon written request to the Corporate Secretary,Assistant General Counsel, Franchise Group, Inc., 2387 Liberty Tax, Inc., 1716 Corporate Landing Parkway,Way, Virginia Beach, Virginia 23454.23456.

Risk Committee

Our Risk Committee, which met fivefour times during Fiscal 2019,2020, is responsible for, among other things, risk governance structure, risk management, and review of operational risk assessment guidelines and policies. All of the current members of our Risk Committee are independent under the rules and regulations of NASDAQ. In addition, our Risk Committee oversees the performance of the internal compliance department, evaluates and reports on the adequacy of our system of internal controls and processes governing all aspects of compliance operations. Our Risk Committee is also responsible for assisting the Board of Directors in its oversight and review of information regarding our risk management approach. The current members of the Risk Committee are listed above.

CORPORATE GOVERNANCE PRACTICES

Meeting Attendance

During Fiscal 2019,The Company maintains robust governance practices and is committed to strong corporate governance practices that are designed to maintain high standards of oversight, accountability, integrity and ethics. The Board believes this commitment promotes and benefits the long-term interests of our stockholders. We regularly review and update our corporate governance practices in response to best practices, changes in law, and other corporate developments, as well as the evolving needs of our business. Additionally, the Company documents key components of its corporate governance system, including through its written Code of Conduct, Insider Trading Policy, Company Corporate Governance Guideline, Disclosure Committee Charter, and Board of Directors held eleven meetings, either in person or by telephone. Each director attended at least 75% of the aggregate of (1) the total number of meetings of the Board of Directors held while he was a director,Charter and (2) the total number of meetings held by all committees on which he served during the periods that he served on the committee.Corporate Governance Guidelines.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires our officers and directors, and beneficial owners of more than 10% of our Common Stock, to file with the SEC reports detailing their ownership of our Common Stock and changes in such ownership. Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file.

There were no late filings of Section 16(a) reports during Fiscal 2019 by our executive officers and directors who served during Fiscal 2019, except for Messrs. Avril, Kahn, Laurence, Riley and Young, who each filed a late Form 3 in connection with their appointment to the Board of Directors.

Director Attendance at Annual Meeting of Stockholders

All Board members attended the Company’s Annual Meeting of Stockholders held on December 13, 2018 with the exception of Mr. Riley. While the Company does not have a formal policy with respect to annual meeting attendance, directors are encouraged to attend all annual meetings of stockholders.

Communications with the Board

Stockholders and other interested parties wishing to communicate with the Board of Directors, the non-employee directors, or an individual Board member concerning the Company may do so by writing to the Board, to the non-employee directors, or to the particular Board member, and mailing the correspondence to the Corporate Secretary, Liberty Tax, Inc., 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454. Please indicate on the envelope whether the communication is from a stockholder or other interested party. In addition, our Board members have made and may in the future make themselves available for consultation and direct communication with significant stockholders.

Code of Conduct

All directors, officers and employees of the Company must adhere to the ethical standards as set forth in the Liberty Tax, Inc.Company's Code of Conduct (the "Code of Conduct"), which was amended in July 2018 to address policies and procedures including, but not limited to, conflicts of interests and related party transactions. The fundamental principles outlined in the Code of Conduct serve as a guide for matters, including but not limited to, adhering to ethical standards in day to day activities, engaging in fair dealings and best business practices, complying with state, federal and foreign laws, identifying conflicts of interest, ensuring financial integrity and reporting violations of the Code of Conduct.

There are many resources in which potential violations of the Code of Conduct may be reported as well as related concerns or to seek guidance on ethical matters through in-person, email and telephone communications. The Company has established aan anonymous Code of Conduct and Compliance Hotline at 800-216-1288844-989-1499 or by email at www.franchisegroup.ethicspoint.com and reports of possible violationviolations can also be made to the Human Resources Director, the Compliance Department on the Compliance Hotline at 877-472-2110 or by email at www.lighthouse-services.com/libtax.

Officer. The Code of Conduct is available at the Company’s website at www.franchisegrp.com or upon written request directed to the Corporate SecretaryAssistant General Counsel in writing at 1716 Corporate Landing Parkway,2387 Liberty Way, Virginia Beach, Virginia 23454,23456, Attention: Corporate Secretary,Assistant General Counsel, or by email at kathleen.curry@libtax.com.tiffany.mcwaters@franchisegrp.com.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONDirector Independence and Board Structure

Messrs. Avril, Cozza, Herskovits, Longfield, Miller, Minner, and Young served as members of our Compensation Committee during Fiscal 2019. No member of our Compensation Committee was, or was formerly, an officer or employee of the Company during Fiscal 2019. None of our executive officers served during Fiscal 2019 as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

NON-EMPLOYEE DIRECTOR COMPENSATION

Non-employee director compensation is reviewed and approved by the Board based on the recommendations of the Compensation Committee of the Board. The Compensation Committee periodically reviews non-employee director compensation in an effort to determine if the Company pays competitive compensation to attract and retain highly-qualified directors. In Fiscal 2019, non-employee directors received the option of an annual retainer of $45,000 or an equal amount of compensation in the form of restricted stock. In addition, for those directors who served on the Audit Committee, Compensation Committee, Nominating Committee and Risk Committee, members received annual retainers of $10,000, $7,500, $5,000 and $5,000, respectively, and the chairpersons received annual retainers of $20,000, $10,000, $7,500 and $7,500, respectively. Our committee members are also entitled to receive this cash compensation in the form of restricted stock, if they so elect. For Fiscal 2019, we also granted each of our non-employee directors stock-based compensation in the form of stock options and restricted stock units (“RSUs”) in a total combined approximate annual value of $65,000. The Chairman of the Board of Directors receives

compensation in an amount 50% greater relative to the other non-employee directors in an equal mix of cash and equity. Non-employee director compensation is unchanged for the fiscal year ending April 30, 2020.

The table below sets forth all compensation paid to our non-employee directors for Fiscal 2019. Information regarding Ms. Ossenfort’s compensation for Fiscal 2019 is included under “Executive Compensation.”

|

| | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | Stock Awards (1) (2) | | Option Awards (3) (4) | | All Other Compensation | | Total |

| Matthew Avril (5) | | $40,652 | | $21,666 | | $43,334 | | $— | | $105,652 |

| Patrick A. Cozza (6) | | 60,054 | | 21,666 | | 43,334 | | — | | 125,054 |

| Gordon D'Angelo (7) | | 12,989 | | — | | — | | — | | 12,989 |

| Thomas Herskovits (8) | | 70,054 | | 21,666 | | 43,334 | | — | | 135,054 |

| John T. Hewitt (9) | | 11,250 | | — | | — | | — | | 11,250 |

| Brian R. Kahn (10) | | 42,228 | | 21,666 | | 43,334 | | — | | 107,228 |

| Andrew M. Laurence (11) | | 51,033 | | 32,499 | | 64,999 | | — | | 148,531 |

| Ross N. Longfield (12) | | 5,897 | | — | | — | | — | | 5,897 |

| Ellen M. McDowell (13) | | 12,690 | | — | | — | | — | | 12,690 |

| Lawrence Miller (14) | | 55,326 | | 21,666 | | 43,334 | | — | | 120,326 |

| G. William Minner, Jr. (15) | | 74,348 | | 21,666 | | 43,334 | | — | | 139,348 |

| Bryant R. Riley (16) | | 45,380 | | 21,666 | | 43,334 | | — | | 110,380 |

| John Seal (17) | | 12,120 | | — | | — | | — | | 12,120 |

| Kenneth M. Young (18) | | 40,652 | | 21,666 | | 43,334 | | — | | 105,652 |

| |

(1) | Amounts in this column reflect the grant date fair value of the restricted stock and RSUs granted to each non-employee director under the Company's 2011 Equity and Cash Incentive Plan, calculated in accordance with FASB Accounting Standards Codification Topic 718 ("ASC Topic 718"), based on the fair market value, as determined by the Board of Directors, of the Company's stock on the effective date of grant. Assumptions used in the calculation of these amounts for Fiscal 2019 are included in Note 10 to the Company's audited financial statements for Fiscal 2019. |

| |

(2) | The value reported in the “Stock Awards” column represents RSUs granted to directors which generally vest and become subject to settlement 12 months after the date of grant. Each RSU represents the right to receive upon settlement of one share of the Company’s Common Stock. The aggregate amount of RSUs outstanding as of April 30, 2019 for each of Messrs. Avril, Cozza, Herskovits, Kahn, Miller, Minner, Riley and Young was 1,804 RSUs and 2,706 RSUs for Mr. Laurence. For each of the awards, the grant date fair value of these awards is calculated using the closing price of the Company's Common Stock on the date prior to grant. |

| |

(3) | Amounts in this column reflect the grant date fair value of the options granted to each director, under the Company's 2011 Equity and Cash Incentive Plan calculated in accordance with ASC Topic 718, based on the fair market value, as determined by the Board of Directors of the Company's stock on the date of grant. |

| |

(4) | The aggregate number of option awards outstanding as of April 30, 2019 for each of Messrs. Avril, Cozza, Herskovits, Kahn, Miller, Minner, Riley and Young was 13,889 options and 20,833 options for Mr. Laurence. Messrs. D’Angelo, Hewitt, Longfield, McDowell and Seal did not have any options outstanding as of April 30, 2019. |

| |

(5) | Fees earned for Mr. Avril includes a $32,772 annual board retainer fee, a $4,728 Compensation Committee member retainer fee, and a $3,152 Risk Committee member retainer fee. |

| |

(6) | Fees earned for Mr. Cozza includes a $41,576 annual board retainer fee, a $9,239 Audit Committee member retainer fee, and a $9,239 Compensation Committee chairman retainer fee. |

| |

(7) | Mr. D'Angelo resigned from the Board effective August 2018. Fees earned for Mr. D'Angelo includes a $11,250 annual board retainer fee and a $1,739 Strategic Planning Committee member retainer fee. |

| |